Exploitation of the Greek state-owned assets: Another opportunity to invest in Greece.

Since 2010, Greece is making a continuous effort to recover from the severe effects of the economic crisis and to boost its economy. Because of the fact that the Hellenic Republic is the biggest owner of properties in the country, the policy makers decided to exploit these properties by selling or leasing land, real estate buildings, and shares of public corporations.

However, it was not easy to handle such huge welfare, because different public companies used to handle (monitor, valuate and exploit) the public properties. The fiscal strategy that Greece is following defines that the public sector must be reformed and some of the public companies must close. So now, there are 2 main institutions, which exploit the state-owned properties.

Hellenic Republic Asset Development Fund

One of the two companies is the “Hellenic Republic Asset Development Fund (HRADF)”. It was established on 1st July 2011 under the medium term fiscal programme. Its legal form is “Societe Anonyme” of which the Hellenic Republic is the only share holder. Its duration is expected to be 6 years, but it may exceed this timeline once the Ministry of Finance decides that would be necessary. Among the members of the Board there are two observers who have been appointed by the European Commission and the Eurozone respectively.

Mission of the Fund

The medium term fiscal programme of 2011 defined that the Greek government had the commitment to develop a Privatisation Programme for the state-owned assets. The Fund was established in order to support and promote this privatization programme in a transparent, rapid, and efficient manner.

Then the Greek government enacted an “Interministerial Committee for Restructing and Privatisation”. This committee (which consist of the ministers of: Finance, Development and Competiveness, Infrastructure, Environment, and Tourism) decides which one of the public properties are ready to be privatized and then it transferred to the HRADF. The fund has the jurisdiction to sell, to develop and to liquidate the 900 assets that have already been transferred to it from the state. These assets are divided into 3 categories:

- Real estate and land development (e.g. 35 real estate buildings, Helliniko S.A.)

- Infrastructure (e.g. Athens International Airports, Regional Airports)

- Corporate (e.g. Hellenic Football Prognostic Organisation, Hellenic Petroleum, Hellenic Post).

Completed Projects

These are some of the completed projects of the fund:

- Helliniko SA. It was the company which was responsible to manage and exploit the land as well as the establishments situated in the area of the former Athens International Airport. On 31 March 2014, it was announced that 100% shares of the company was sold to a private investor. The purchase price was 915 million Euros.

- Hellenic Football Prognostics Organisation S.A. On 11 October 2013 33% of the company shares were sold to a private company. The purchase price was 652 million Euros.

- State Lottery Tickets. On 30 July 2013, the rights to operate circulate and manage the Lottery Tickets were transferred to a private company for 12 years. The purchase price was 770 million Euros.

- Real Estate Buildings. So far, 28 real estate properties have been sold or leased with total revenue 261,3 million Euros.

Since 2011, the Fund has received 2,6 billion Euros through the implementation of the privatization programme.

In –progress Projects

These are some of the on-going projects of the HRADF:

- Piraeus Port Authority S.A.(OLP) / Thessaloniki Port Authority S.A(OLTH). The HRADF wishes to sell the 67% of the shares of both these companies. There are already 6 different available proposals for the OLP.

- 12 more port authorities. The Fund wishes to sell shares of twelve more port authorities.

- 37 Regional airports. The HRADF wishes to privatise the airport authorities of 37 greek airports.

- Thessaloniki Water Supply and Sewerage Company S.A. The fund invited the investors to purchase the 51% of the shares of the company.

Future Projects

The HRADF is about to proceed to the following actions within the next 12 months

- Privatisation of the Hellenic Post: the Hellenic Republic is holding 90% of the shares. It wishes to sell this percentage.

- Selling of the 17% of the shares of the Public Power Corporation S.A.

- Selling of shares of Athens Water Supply and Sewerage Company S.A

- Acquisition of the ownership right on the “Aghia Triada” land. It is a seafront property of 132,483 m2 located 27 km from the center of Thessaloniki city.

Public Property Company

There is a second company which is entitled to exploit the state-owned properties. It was first established in 1998 (with a different name) and its main objective was to exploit the tourist properties of the country. In 2011, it merged two other state-owned companies with similar activities and it got its final name – Public Properties Company SA (PPC).

Nowadays, the PPC is handling more than 70.000 state –owned properties mostly of tourism interest (marinas, ski resorts, camping, spa resorts). The PPC exploits all these properties which have not been transferred to HRADF. It may lease some of them (the leaser in most cases has the obligation to invest money to renovate the place) but it may manage them as “branch offices”. Examples of these branch offices are the “Parnassos Ski resort” and the Vouliagmeni Seashore SA (a land situated in south Athens area and offers leisure and sea-related services).

Projects of PPC

- Nafplia Palace Hotel: it is a group of 3 hotels situated in Nafplio – Peloponnese. The PPC has signed a leasing contract with an investor who is obligated to invest 6,3 million euros to renovate the whole group.

- The PPC will run the renovation works of the lifts at Parnassos Ski Centre from July to November 2014. The cost of this project is estimated around the 29,5 million and it will be delivered through the National Reference Framework.

The first e-auction for properties

The most innovative project that PPC is running is the website:

www.e-publicrealestate.gr. It is an electronic – Ebay style – platform where the smaller public properties are auctioned. It runs since July 2013 and it aims to make these properties accessible to as many investors as possible. The types of properties that can be auctioned are residential, commercial, sports and tourist facilities and / or urban and rural land. In the near future, 16 are scheduled but no specific dates are given yet.

The co-ordination of the HRADF and the PPC

So far, the two companies used to cooperate for a small amount of properties. The PPC used to promote “mature” projects which were ready to be privatized such as the case of Helliniko S.A. The updated memorandum defines that the two companies will cooperate more in the future. More specifically, PPC will make sure that the properties are not mortgaged and they can be transferred to the HRADF. It is expected that by the end of 2015, 3000 properties will be transferred to the HRADF.

Exploitation of the church properties

A third company entitled to exploit properties is the newly established (January 2014) company responsible for the exploitation of church properties. It is half-owned by the Holy Archbishopry of Athens and half-owned bt the Hellenic Republic. The properties which the company will manage can only be leased. They cannot be sold. The state will receive the 50% of the incomes and the other 50% will be used for the church charities. The first property to be leased is a land of 83.000 m2 located to Vouliagmeni, south of Athens.

The advantages of the privatization programme for the economy of the country

The Greek government is making every effort to boost the economy. This aim can be achieved by attracting new investors. The privatization programme was one step towards this objective. Privatisations will not only help to reduce the public debt, but they will also bring some indirect benefits. The privatised properties will be developed by the investors and thus new jobs will be created. The underutilized assets will be used in a more effective way (as it will happen in the case of Helliniko or even Aghia Triada). The local communities and economies will be boosted. In the end, privatizations is a tool that enhances the good business climate that the new investors want to see in Greece.

Gesamten Artikel lesen »

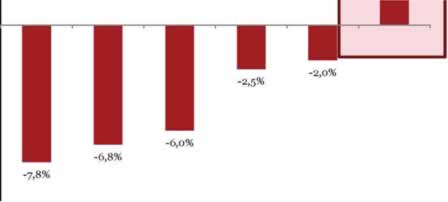

EE17 – Konjukturbereinigte Primärbilanz (% BIP)

Griechenland - Konjukturbereinigte Primärbilanz (% BIP)

Griechenland – Gesamtstaatliche Bilanz (% BIP)

Griechenland – Gesamtstaatliche Primärbilanz (% BIP)

Quelle: Nationales Statistisches Amt, IWF, Nationale Bank Griechenlands

EE17 – Konjukturbereinigte Primärbilanz (% BIP)

Griechenland - Konjukturbereinigte Primärbilanz (% BIP)

Griechenland – Gesamtstaatliche Bilanz (% BIP)

Griechenland – Gesamtstaatliche Primärbilanz (% BIP)

Quelle: Nationales Statistisches Amt, IWF, Nationale Bank Griechenlands

Quelle: Nationales Statistisches Amt, IWF, Nationale Bank Griechenlands

Quelle: Nationales Statistisches Amt, IWF, Nationale Bank Griechenlands

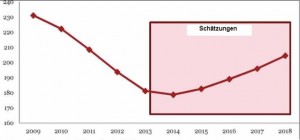

Quelle: Economist Intelligence Unit

Nach Angaben des IWF ist infolge der zunehmenden Investitionen in 2016 mit einem Anstieg

Quelle: Economist Intelligence Unit

Nach Angaben des IWF ist infolge der zunehmenden Investitionen in 2016 mit einem Anstieg

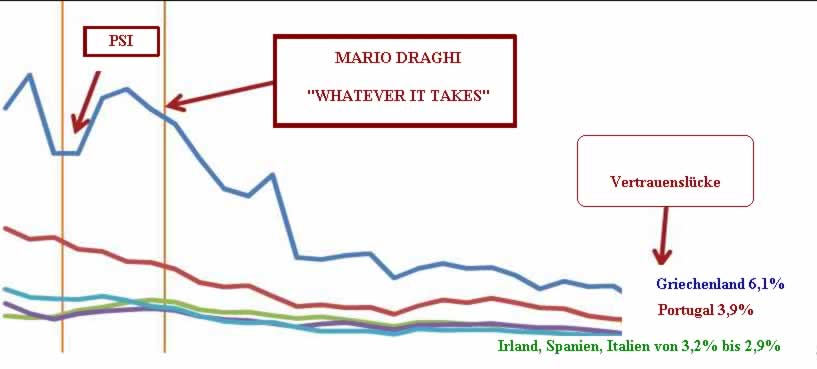

Quelle: Europäische Kommission

Rückgewinnung des Vertrauens in die griechische Wirtschaft

Rendite der Staatsanleihen

Quelle: Europäische Kommission

Rückgewinnung des Vertrauens in die griechische Wirtschaft

Rendite der Staatsanleihen

Rendite von Staatsanleihen (10-jährig)

Rendite von Staatsanleihen (10-jährig)

Quelle: Bloomberg

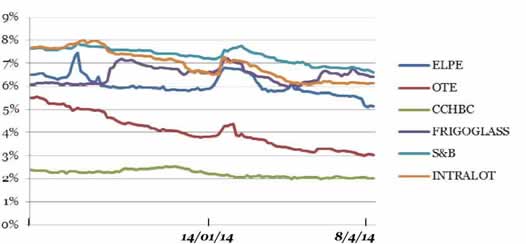

Aktuelle Anschauungsbeispiele für die Wiederherstellung des Vertrauens

Quelle: Bloomberg

Aktuelle Anschauungsbeispiele für die Wiederherstellung des Vertrauens

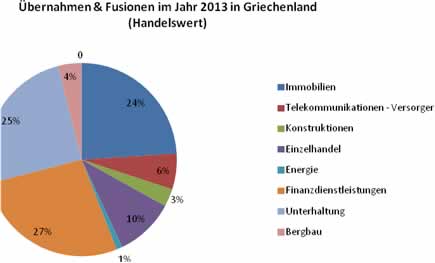

Die Mehrheit der Transaktionen betrifft die Umstrukturierung der Banken und die Privatisierungen

Die Mehrheit der Transaktionen betrifft die Umstrukturierung der Banken und die Privatisierungen

Before the outbreak of the financial crisis in 2009, the growth rates in Greece were very high – the average rates of growth were significantly higher than the European Union average. The crisis unveiled that this development was not real and it was financed by external public sector borrowing. This extensive borrowing led to the gradual increase of the fiscal deficit (the public debt reached the highest level in Europe – almost 120% of the GDP).

As a result, Greece could no longer borrow from the international capital markets and it was made clear that from that point the European Union (EU), the European Central Bank (ECB) and the International Monetary Fund (IMF) could finance the needs of Greece. The support of these 3 institutions was supplied

under the presupposition that the country would implement very radical structural reforms which often came at an enormous social cost. Indeed, numerous structural reforms were adopted during the last four years in order to return to a sustainable growth path. According to the data provided by the Organisation for Economic Co-operation and Development (OECD), Greece has implemented the largest fiscal adjustment programme compared to the member countries of the OECD.

Due to this programme, the Greek economy is showing again some encouraging signs of development. For the first five months of 2014, there was a primary budget surplus of 711 million Euros (with the target being 208 million Euros). The situation for the same last year was completely opposite: there was a deficit of 970 million Euros. In 2013, Greece had the lowest inflation rate in the eurozone and the consumer price inflation turned negative in March 2013. Unemployment rate shows signs of stability, even though it remains at unacceptably high levels (jobless rate remained stable at 27,8% for the first three months of the year compared to the same period of last year).

Before the outbreak of the financial crisis in 2009, the growth rates in Greece were very high – the average rates of growth were significantly higher than the European Union average. The crisis unveiled that this development was not real and it was financed by external public sector borrowing. This extensive borrowing led to the gradual increase of the fiscal deficit (the public debt reached the highest level in Europe – almost 120% of the GDP).

As a result, Greece could no longer borrow from the international capital markets and it was made clear that from that point the European Union (EU), the European Central Bank (ECB) and the International Monetary Fund (IMF) could finance the needs of Greece. The support of these 3 institutions was supplied

under the presupposition that the country would implement very radical structural reforms which often came at an enormous social cost. Indeed, numerous structural reforms were adopted during the last four years in order to return to a sustainable growth path. According to the data provided by the Organisation for Economic Co-operation and Development (OECD), Greece has implemented the largest fiscal adjustment programme compared to the member countries of the OECD.

Due to this programme, the Greek economy is showing again some encouraging signs of development. For the first five months of 2014, there was a primary budget surplus of 711 million Euros (with the target being 208 million Euros). The situation for the same last year was completely opposite: there was a deficit of 970 million Euros. In 2013, Greece had the lowest inflation rate in the eurozone and the consumer price inflation turned negative in March 2013. Unemployment rate shows signs of stability, even though it remains at unacceptably high levels (jobless rate remained stable at 27,8% for the first three months of the year compared to the same period of last year).

Greece is an ideal tourist destination. It is a country with unique and diverse landscape, ancient history and heritage. Tourism has always been considered as the main pillar of the Greek economy. The economic crisis in Greece unveiled that in fact, tourism was not considered to be part of a serious national strategy. The present economic situation makes clear that tourism - must be used as a vehicle for the re-ignition of the Greek economy as long as several structural reforms are achieved and appropriate legal framework is implemented.

The European Union thinks of tourism as a sector of special interest because of the fact that tourism contributes for 10% of the EU GDP and employs 20 million people. According to World Tourism Organization (UNWTO), during the year 2013 1,08 billion of citizens have travelled around the world, half of ten have visited Europe. Therefore, it is obvious that tourism can play an even greater role in the years ahead, towards the economic growth of the EU. This truth is also valid in Greece, where the tourism sector contributes 16,4% to the national GDP. On these grounds, the Greek EU Presidency promotes all the policies decided by member-states, so that Europe remains the top destination on the tourism map.

Furthermore, taking into consideration that among the European countries, Greece has the second place with 16.500 km of coastlines (first being Norway), it is not a surprise that the Greek government aims to enhance its Coastal and Maritime Tourism. It will be one of the major fields of Action of the Greek Presidency.

Greece is an ideal tourist destination. It is a country with unique and diverse landscape, ancient history and heritage. Tourism has always been considered as the main pillar of the Greek economy. The economic crisis in Greece unveiled that in fact, tourism was not considered to be part of a serious national strategy. The present economic situation makes clear that tourism - must be used as a vehicle for the re-ignition of the Greek economy as long as several structural reforms are achieved and appropriate legal framework is implemented.

The European Union thinks of tourism as a sector of special interest because of the fact that tourism contributes for 10% of the EU GDP and employs 20 million people. According to World Tourism Organization (UNWTO), during the year 2013 1,08 billion of citizens have travelled around the world, half of ten have visited Europe. Therefore, it is obvious that tourism can play an even greater role in the years ahead, towards the economic growth of the EU. This truth is also valid in Greece, where the tourism sector contributes 16,4% to the national GDP. On these grounds, the Greek EU Presidency promotes all the policies decided by member-states, so that Europe remains the top destination on the tourism map.

Furthermore, taking into consideration that among the European countries, Greece has the second place with 16.500 km of coastlines (first being Norway), it is not a surprise that the Greek government aims to enhance its Coastal and Maritime Tourism. It will be one of the major fields of Action of the Greek Presidency.